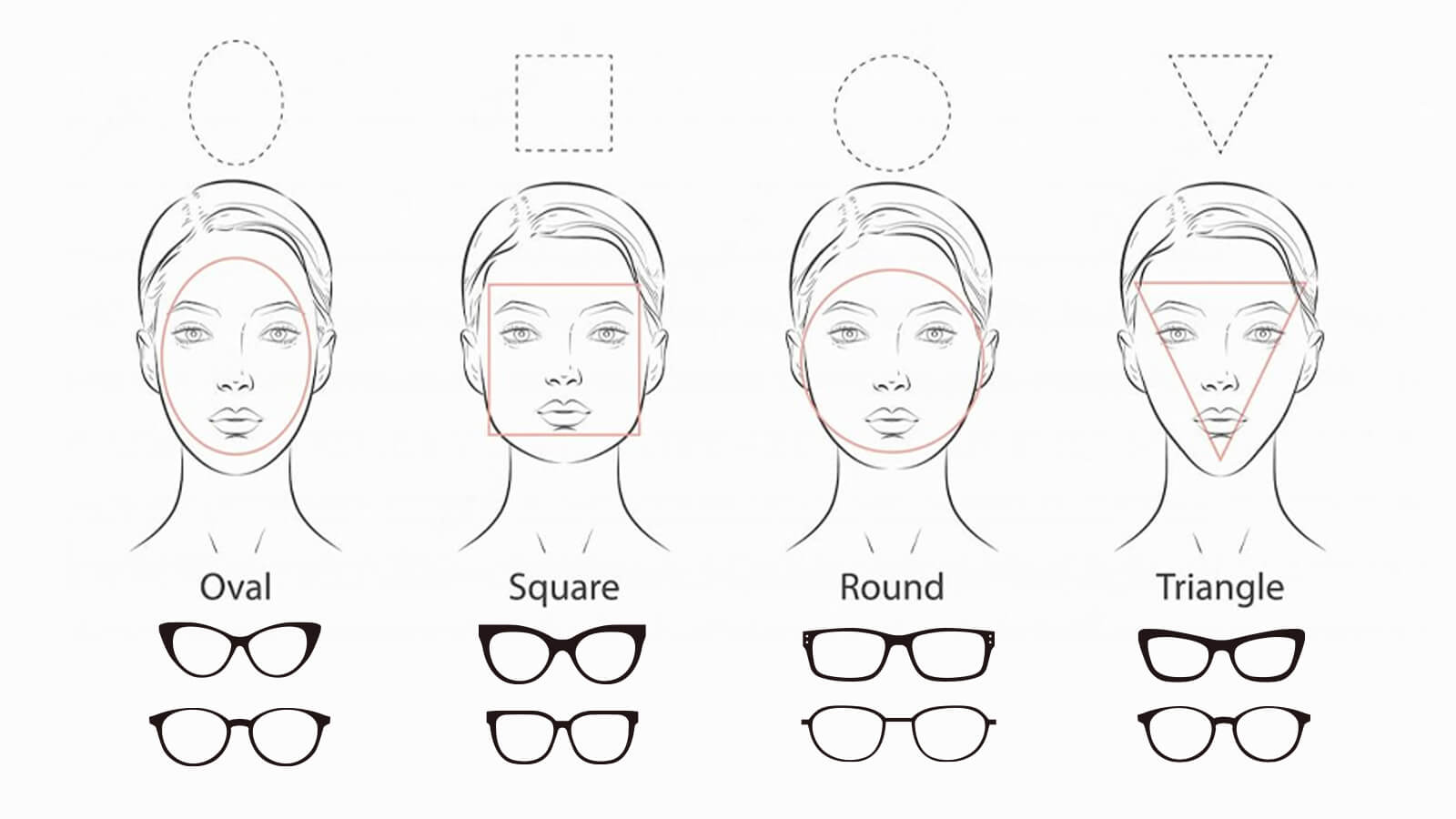

Guide to Picking Glasses That Suit Your Face Shape Perfectly

February 27,2023

What is Boho Style? A Comprehensive Guide to Boho-Chic Fashion

February 13,2025

Virtual Glasses Try On - Find Your Perfect Pair Online

April 02,2024

UV Protection Glasses VS. Blue Light Glasses - Vooglam

July 20,2023

Newest Style Modern Trendy Mens Glasses | Vooglam

March 01,2024

Stylish Reading Glasses: Blending Fashion with Functionality

February 16,2023

Photochromic Lenses 101: How They Work & Why You Need Them

September 22,2023

Brown Eyes: The Beauty of the Most Common Hue

September 01,2024

The chubby face glasses for round face female

August 02,2023

What are prisms in eyeglasses?

March 20,2023

What Are Bifocal Glasses? The Complete Guide (Types, History & Benefits)

April 14,2023

How to Read Your Eyeglass Prescription?

March 11,2023

Can You Use HSA for Glasses? (Yes, and Here Is How)

If you have a Health Savings Account (HSA), you are sitting on a powerful financial tool. Unlike a standard bank account, it’s tax-free. And unlike a Flexible Spending Account (FSA), the money is yours forever.

But when it comes to vision care, many people leave that money untouched because they are unsure of the rules.

Can you use your HSA for glasses?

The answer is a definitive Yes. Prescription eyeglasses, sunglasses, and even readers are fully eligible medical expenses.

Here is your complete guide to unlocking your HSA funds for better vision—and why buying eyewear is one of the smartest ways to invest your health savings.

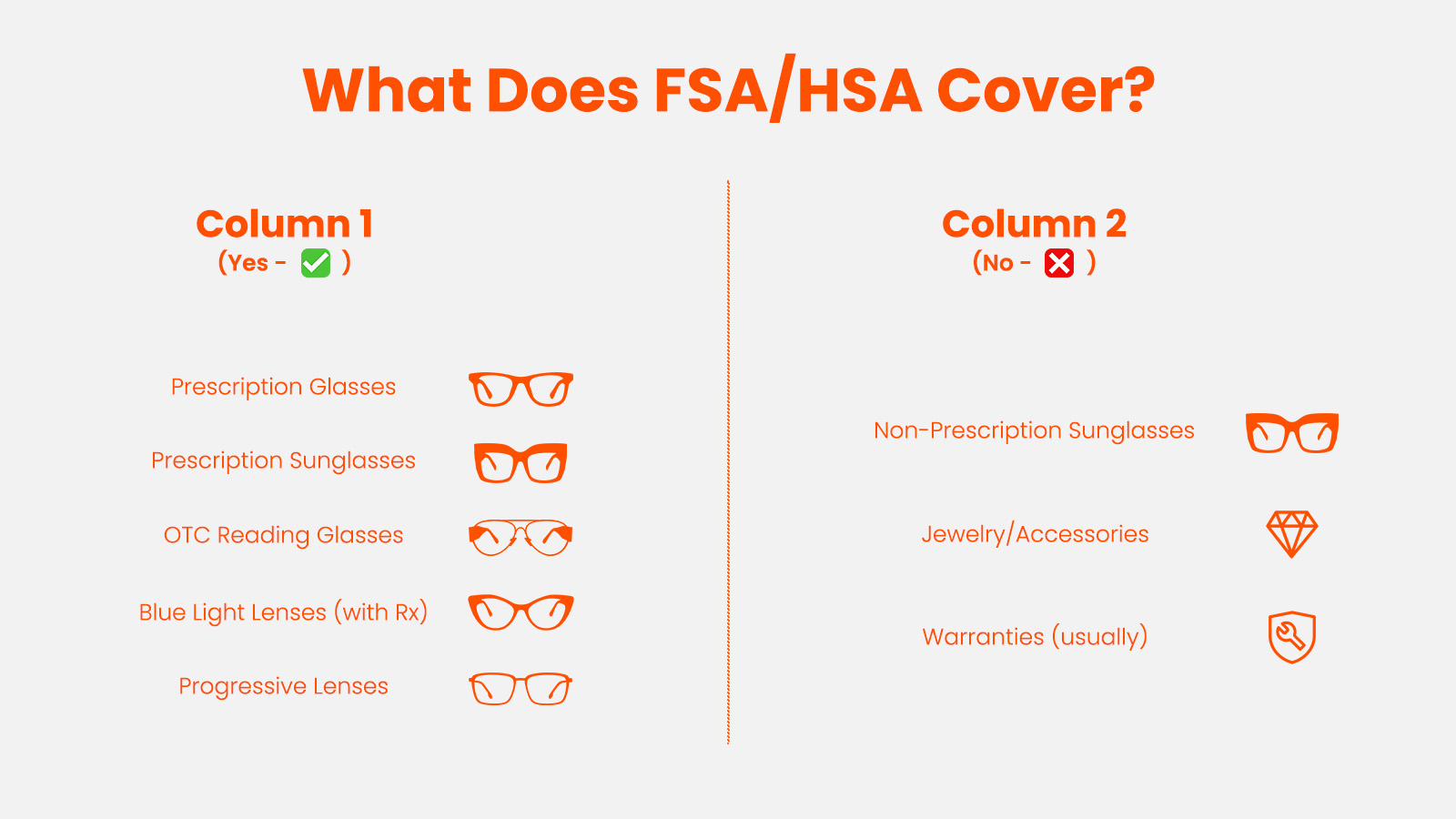

What Exactly Is Covered by Your HSA? (The 2025 List)

The IRS classifies "vision correction" as a qualified medical expense. This means you can use your pre-tax HSA dollars for almost anything that helps you see better.

Here is the breakdown of what is eligible at Vooglam:

- Prescription Eyeglasses: This covers both the frames and the lenses (including Single Vision, Bifocals, and Progressives).

- Prescription Sunglasses: Yes, you can buy designer-style sunglasses tax-free, as long as they have your prescription in them.

- Reading Glasses: Both prescription readers and Over-the-Counter (OTC) readers are eligible because they treat presbyopia.

- Blue Light Glasses (With a Catch):

- Eligible: Prescription Blue Light glasses and Blue Light Reading glasses (because the magnification makes them a medical device).

- Not Generally Eligible: Non-prescription (Plano) blue light glasses usually require a "Letter of Medical Necessity" from a doctor to prove they are for a specific condition like migraines, rather than just general wellness.

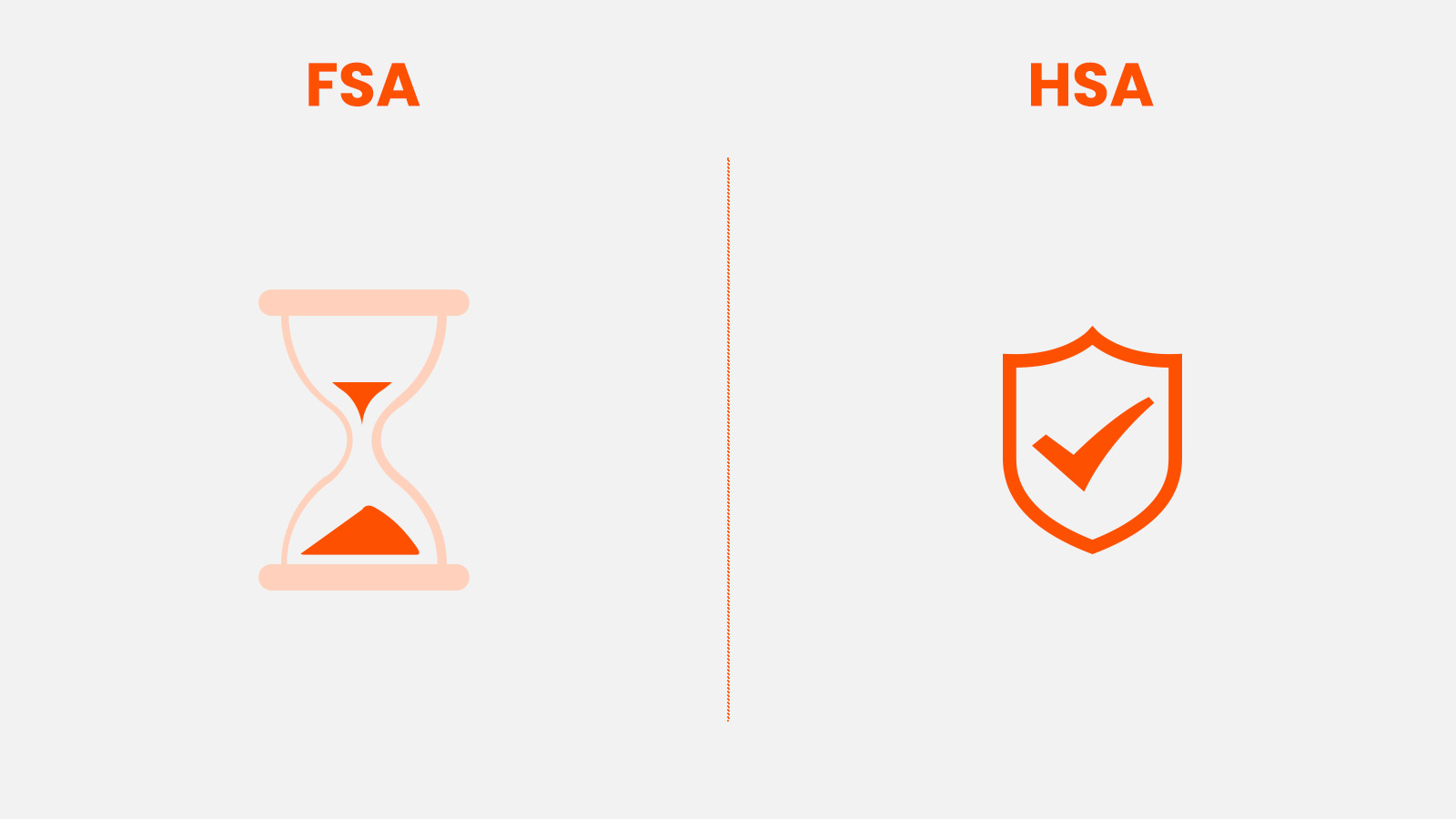

FSA vs. HSA: The Critical Difference You Need to Know

While both accounts let you buy glasses tax-free, they work very differently. Understanding this difference is key to your shopping strategy.

| Feature | FSA (Flexible Spending Account) | HSA (Health Savings Account) |

| Who Owns It? | Your Employer | You |

| Does it Expire? | Yes. "Use it or Lose it" by Dec 31. | No. Funds roll over year after year. |

| Strategy | Panic: Spend it quickly before it vanishes. | Invest: Save up for premium frames or Progressive lenses. |

Confused about expiring funds? If you actually have an FSA (not an HSA), stop reading this and check our Guide to Unused FSA Funds immediately.

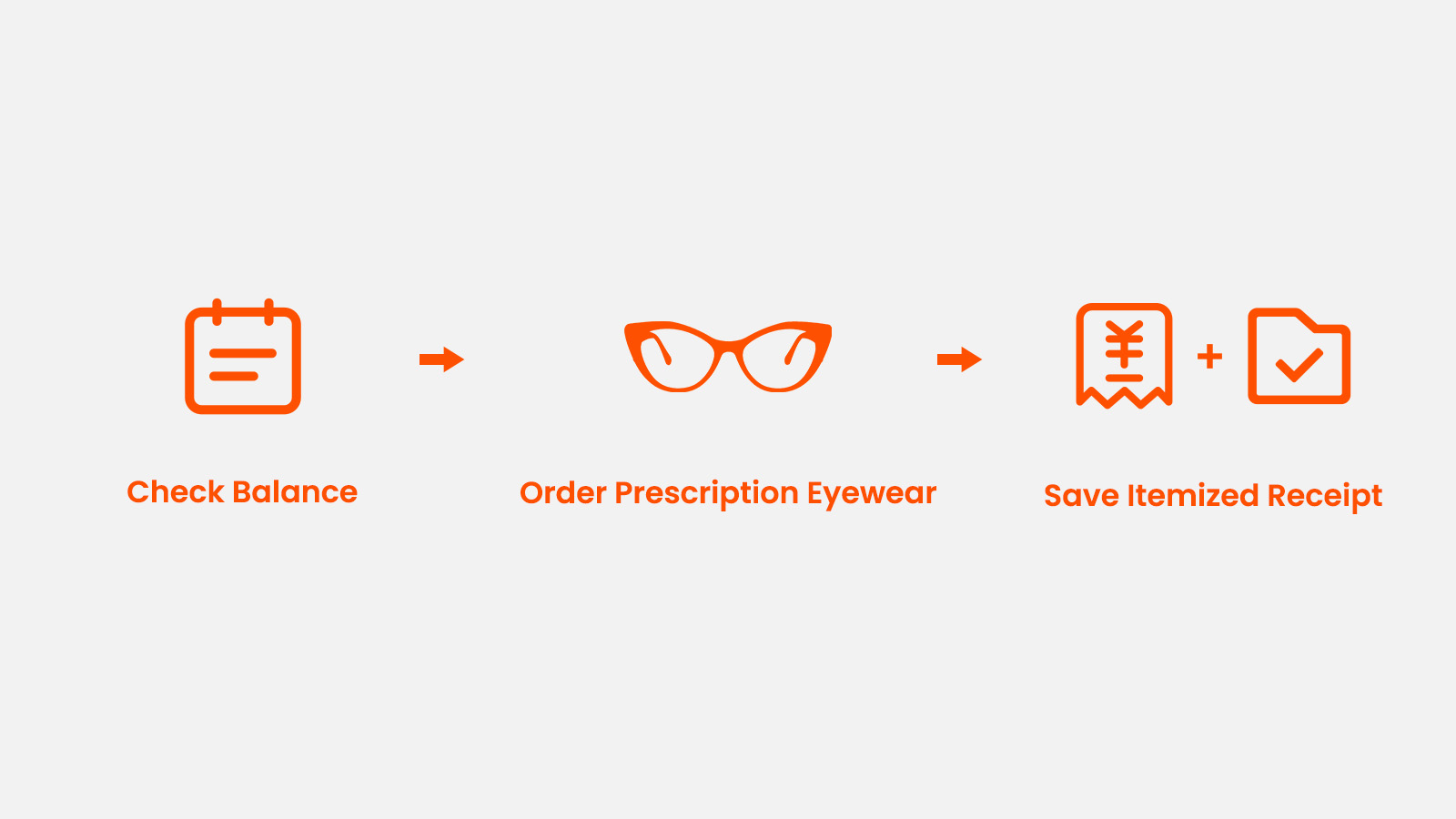

How to Buy Glasses Online with an HSA Card

Buying glasses with an HSA is just as easy as using a debit card. You have two main options:

Option A: The Reimbursement Method (The "Smart" Strategy)

We recommend this method. Many savvy HSA users pay with a personal credit card (to earn travel points or cash back) and then pay themselves back from their HSA later.

- Pay for your glasses with your personal credit card.

- Save the Vooglam itemized invoice (emailed to you automatically).

- Log into your HSA portal and request a "Distribution" or "Reimbursement" for that amount.

- Transfer the cash back into your bank account.

Need help with the paperwork? Visit our FSA/HSA Collection to get our Claim Guide and learn exactly how to download your invoice.

Option B: The Direct Payment

You can try entering your HSA card number directly in the credit card field at checkout.

- Note: Some HSA administrators automatically decline online optical transactions to prevent fraud. If your card is declined, don't worry—simply switch to Option A above!

3 Hidden Benefits of Your HSA

Your HSA is more flexible than most vision insurance plans. Here is how to maximize it:

1. No "One Pair" Limit

Vision insurance often limits you to one pair of glasses every 12–24 months. Your HSA has no such limit. You can buy a pair for work, a pair of prescription sunglasses, and a backup pair, as long as you have the funds.

2. It Covers Your Family

You can use your HSA funds to buy glasses for your spouse and tax dependents (children), even if your specific health insurance plan does not cover them.

3. The 2025 Contribution Boost

The IRS has raised the contribution limits for 2025. Individuals can now contribute up to $4,300, and families can contribute $8,550. This gives you even more tax-free power to upgrade your eyewear this year.

Invest in Your Vision Today

Your HSA isn't just a savings account; it’s an investment in your daily life. Don't let inflation eat your savings—use those pre-tax dollars to see the world clearly.

Shop HSA-Eligible Eyeglasses & Get Claim Guide

FAQ: Your Top HSA Questions Answered

Can I buy frames now and lenses later?

Generally, yes, but the frames must be intended for prescription use. However, it is always smoother to buy the complete pair (Frame + Lens) in one transaction to ensure your receipt clearly shows "Prescription Eyeglasses".

Does my HSA cover shipping costs?

Yes. Shipping costs associated with the delivery of a medical device (like glasses) are generally considered part of the eligible medical expense.

What if I change jobs? Do I lose my HSA?

No. Your HSA is portable. It stays with you even if you change employers or retire. You can continue to use those funds for glasses at Vooglam for years to come.

Vooglam Blog

Vooglam blog shares professional knowledge about eyeglass frames, lenses, etc., and provides help when purchasing and using eyewear products. At the same time, Vooglam focuses on fashion glasses to interpret the trend of glasses for you.

Office to Gala: 3 Styling Formulas for Your Day-to-Night Wardrobe

We know the drill. You have a concept pitch at a creative studio at 2:00 PM, a gallery walk-through at 6:00 PM, and a live gig at a basement venue that doesn't even kick off until midnight. You are no

January 29,2026

Experimental Eyewear: When Glasses Become Wearable Art

From Function to FormWalk into any gallery opening in Berlin, Tokyo, or New York and you'll notice something: the people who actually care about design aren't wearing Persol or Oliver Peoples anymore.

January 27,2026

The Best Streetwear Sunglasses & Glasses of 2026 (Vooglam's Editor's Picks)

Streetwear eyewear has reached a turning point. What started as logo-heavy collaborations and hype drops has evolved into something more interesting: frames that prioritize actual design innovation al

January 27,2026

The Ultimate Valentine’s Gift Guide: Bold Symbols of Affection in Black & Red

Love is rarely just "sweet." At its best, it is intense, enduring, and a little bit rebellious. Yet, every February, we are bombarded with soft pinks and disposable chocolates. This year, we are sugge

January 26,2026