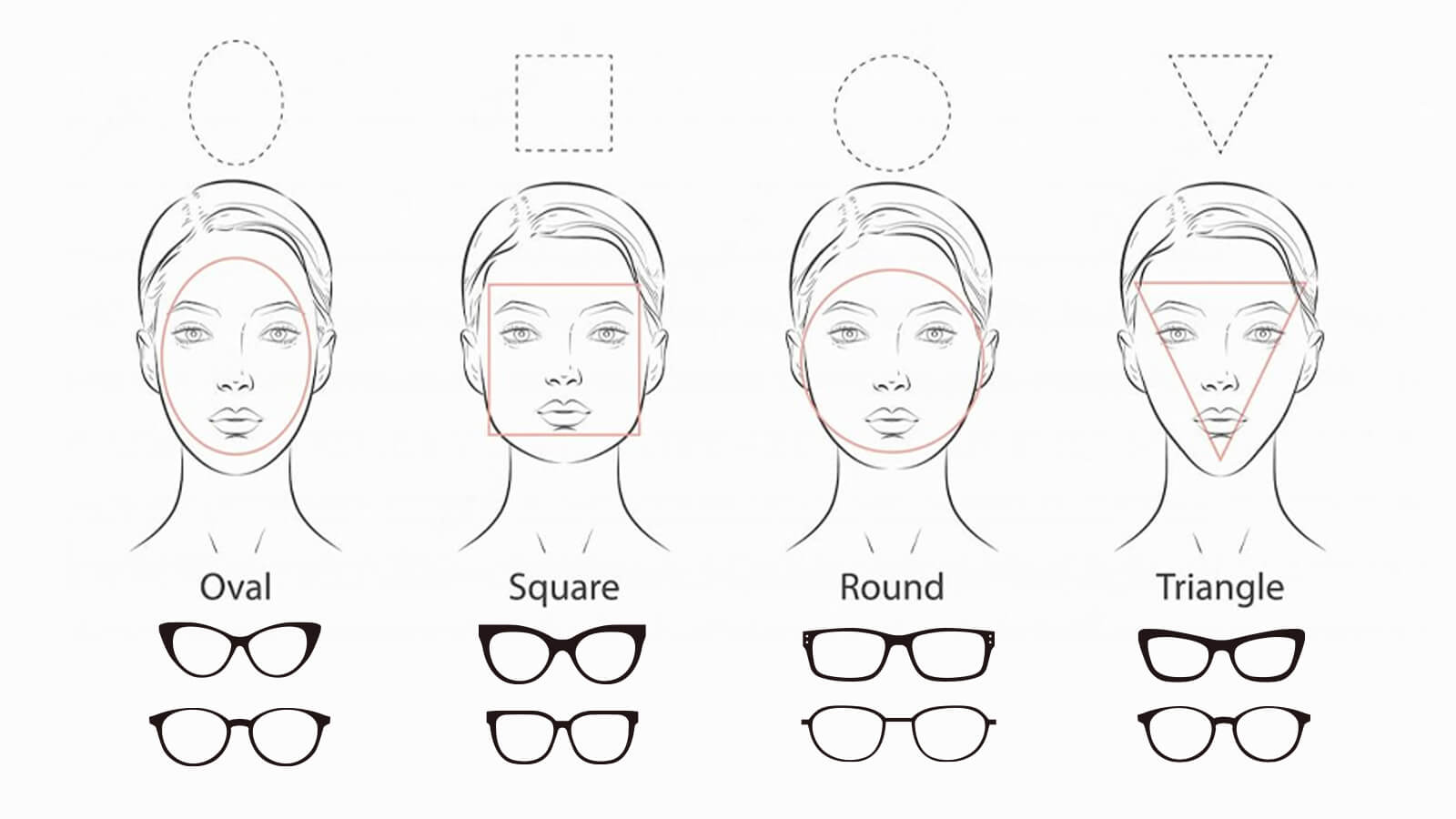

Guide to Picking Glasses That Suit Your Face Shape Perfectly

February 27,2023

What is Boho Style? A Comprehensive Guide to Boho-Chic Fashion

February 13,2025

Virtual Glasses Try On - Find Your Perfect Pair Online

April 02,2024

UV Protection Glasses VS. Blue Light Glasses - Vooglam

July 20,2023

The Ultimate Guide to Modern Trendy Men's Glasses: Top Styles for 2026

March 01,2024

Stylish Reading Glasses: Blending Fashion with Functionality

February 16,2023

Photochromic Lenses 101: How They Work & Why You Need Them

September 22,2023

Brown Eyes: The Beauty of the Most Common Hue

September 01,2024

The chubby face glasses for round face female

August 02,2023

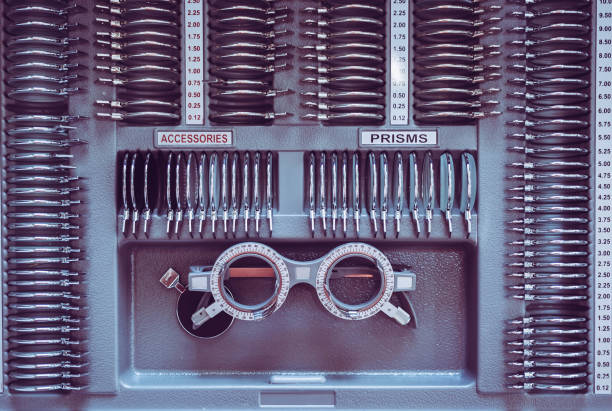

What are prisms in eyeglasses?

March 20,2023

What Are Bifocal Glasses? The Complete Guide (Types, History & Benefits)

April 14,2023

How to Read Your Eyeglass Prescription?

March 11,2023

What Happens to Unused FSA Funds? (And How to Save Them)

It’s the holiday season. You’re checking your lists, buying gifts, and maybe, just maybe, you log into your benefits portal—and panic.

You see a balance remaining in your Flexible Spending Account (FSA). Maybe it’s $50, maybe it’s $400. The calendar says December, and you remember hearing something about "use it or lose it."

Does that money just disappear on December 31st?

The short answer is: Yes, it usually does. But the long answer is, "Not always, and there are smart ways to save it if you act fast."

Here is the complete guide to what happens to unused FSA funds, the "loopholes" that might buy you time, and the smartest ways to spend your balance before the clock runs out.

- Do FSA Funds Expire? The "Use-It-Or-Lose-It" Rule Explained

- 3 Ways to Keep Your Money: Grace Periods & Rollovers

- 5 Smart Ways to Spend Unused FSA Funds Before Dec 31

- Don't Get Denied: The "Order Date" vs. "Ship Date" Trap

- Can I Return FSA Items? (Avoiding the Refund Trap)

- Don't Let Your Money Vanish

- FAQ: Your Top FSA Questions Answered

Do FSA Funds Expire? The "Use-It-Or-Lose-It" Rule Explained

Unlike a Health Savings Account (HSA), which acts like a long-term savings account where funds roll over forever, an FSA is designed for immediate spending.

Because FSA contributions are pre-tax (lowering your taxable income), the IRS enforces strict rules to prevent people from using them as tax shelters. The general rule is that any funds contributed in a calendar year must be spent on eligible medical expenses incurred during that same year.

If you have $200 left on January 1st and your plan doesn't have special provisions, that money is forfeited. It goes back to your employer to cover administrative costs; it does not go into your pocket.

3 Ways to Keep Your Money: Grace Periods & Rollovers

Before you consider that money gone, check your plan description. Many employers now offer one of three exceptions to the strict deadline rule.

Note: You usually only get one of these options, not all of them.

1. The Grace Period (Extra 2.5 Months)

Some plans offer an extra 2.5 months to spend your funds. This extends your spending deadline from December 31st to March 15th of the following year. If your plan has this, you can breathe easy—you have time to schedule appointments or order glasses.

2. The 2025 Carryover Rule (Save up to $660)

This is the best-case scenario. Some plans allow you to carry over a specific amount of unused funds into the following year.

- For 2025 plans: The IRS allows a carryover of up to $660.

- For 2024 plans: The limit was $640.

If you have $500 left and your plan allows carryover, you don't need to panic spend. That money will be there for you in January. But if you have $1,000 left, you must pay the excess (anything over the limit) by December 31st, or you will lose it.

3. The Run-Out Period (Don't Get Confused!)

This is the most common point of confusion. A "Run-Out Period" gives you extra time to submit paperwork, not extra time to spend.

- Example: You bought prescription glasses on December 20th, but didn't submit the receipt. A 90-day run-out period lets you submit that claim until March 31st.

- Warning: You cannot buy new items during the run-out period.

5 Smart Ways to Spend Unused FSA Funds Before Dec 31

If you’ve confirmed you don’t have a grace period or rollover, you need to spend that money now. But spending it wisely is harder than it sounds.

You don't need 20 first-aid kits. You probably don't need a third blood pressure monitor.

The smartest investment for unused FSA funds is prescription eyewear. Why? It is a high-ticket item that improves your daily quality of life, uses up a significant portion of your balance in one transaction, and is 100% FSA eligible.

Here is how to maximize your remaining balance at Vooglam:

1. Get a Spare Pair of Glasses (The "Life-Saver")

If you wear glasses daily, you know the terror of breaking them. Use your FSA funds to buy a "backup" pair. Since FSA funds cover frames and prescription lenses, this is the perfect time to grab a bold, fun style you might not pay for out-of-pocket.

Browse Women's Glasses | Browse Men's Glasses

2. Upgrade to Prescription Sunglasses (Tax-Free Style)

This is the ultimate "loophole" luxury. You can use pre-tax dollars to buy stylish sunglasses, as long as they have prescription lenses. It feels like buying a fashion accessory, but the IRS counts it as a medical device.

3. Stock Up on Reading Glasses

Even if you don't have a strong prescription, reading glasses (and even blue-light blocking lenses) are often eligible expenses. These make excellent additions to your home office or bedside table.

4. Protect Your Eyes with Blue Light Glasses

If you stare at screens all day, use your funds to buy blue light blocking glasses. Tip: Opt for Blue Light Reading Glasses (even with low magnification like +0.00 or +0.50) to ensure they are classified as a medical device.

5. Invest in Progressive Lenses

If you wear bifocals, use your FSA to upgrade to progressives (no-line multifocals). These are more expensive than standard lenses, making them the perfect candidate for spending down a large FSA balance.

Don't Get Denied: The "Order Date" vs. "Ship Date" Trap

If you are reading this in late December, you need to be careful.

Most FSA plans base eligibility on the Service Date (the date you place the order), not the date the item arrives. However, some strict plans require the item to ship before the deadline.

Our Advice: Do not wait until 11:59 PM on New Year's Eve. Custom prescription lenses take time to process. Place your order at least one week before the deadline to ensure the transaction clears and your invoice is dated correctly.

Can I Return FSA Items? (Avoiding the Refund Trap)

Here is a trap that catches many people.

Let’s say you buy glasses with FSA funds on December 28th. They arrive in January, but they don't fit perfectly. You decide to return them for a refund.

- The Problem: Vooglam (and most merchants) must refund the original payment method—your FSA card. But since the plan year is closed, the refunded money might be instantly forfeited to your employer. You get nothing.

- The Fix: If you need to return an FSA purchase after the year ends, always ask for Store Credit or an Exchange instead of a refund. This keeps the value in your hands.

Don't Let Your Money Vanish

The deadline is closer than you think. Check your FSA balance today, then head over to our FSA Eligible Collection to turn those expiring dollars into perfect vision. There's also a dedicated Claim Guide that shows you exactly how to download your invoice and submit it to your provider.

FAQ: Your Top FSA Questions Answered

Can I use my FSA card directly at Vooglam?

We recommend paying with your personal credit or debit card and submitting the itemized receipt for reimbursement. This ensures a smooth transaction (as some FSA cards can be declined online) and allows you to keep the credit card rewards points! You can download your official invoice from your Vooglam account immediately after purchase.

What happens to FSA funds if I quit my job?

If you leave your job, your FSA usually terminates on your last day of work. Any unspent funds are forfeited immediately, even if it's the middle of the year. This is why it's smart to spend your balance before you hand in your notice.

Can I use FSA funds for my spouse?

Yes. You can use your FSA funds to pay for eligible medical expenses for your spouse and qualified dependents, even if they are not on your health insurance plan.

Vooglam Blog

Vooglam blog shares professional knowledge about eyeglass frames, lenses, etc., and provides help when purchasing and using eyewear products. At the same time, Vooglam focuses on fashion glasses to interpret the trend of glasses for you.

How to Look Good With Glasses: Style Your Hair, Outfits, and Accessories

For a long time, glasses were seen as a medical necessity—something you "had" to wear. But the narrative has flipped. Today, glasses are one of the most powerful accessories in your wardrobe. They fra

February 10,2026

Office to Gala: 3 Styling Formulas for Your Day-to-Night Wardrobe

We know the drill. You have a concept pitch at a creative studio at 2:00 PM, a gallery walk-through at 6:00 PM, and a live gig at a basement venue that doesn't even kick off until midnight. You are no

January 29,2026

Experimental Eyewear: When Glasses Become Wearable Art

From Function to FormWalk into any gallery opening in Berlin, Tokyo, or New York and you'll notice something: the people who actually care about design aren't wearing Persol or Oliver Peoples anymore.

January 27,2026

The Best Streetwear Sunglasses & Glasses of 2026 (Vooglam's Editor's Picks)

Streetwear eyewear has reached a turning point. What started as logo-heavy collaborations and hype drops has evolved into something more interesting: frames that prioritize actual design innovation al

January 27,2026